Carrier Global Corporation reported strong financial results for the fourth quarter and full year of 2022. The company projects continued organic growth in 2023 and is well-positioned with a strong balance sheet with significant capital to deploy towards continued value creation.

"Our fourth quarter results represent the culmination of a year marked by strong execution and innovation. In 2022, we delivered on our organic sales growth, adjusted operating margin expansion and adjusted EPS growth commitments, in line with our value creation framework amidst an uncertain macro environment," said Carrier Chairman & CEO Dave Gitlin. "I am proud of the strategic progress we made in 2022, including the expansion of our global digital platforms for buildings and cold chain solutions, Abound and Lynx, and the significant portfolio actions we took including the divestiture of Chubb and acquisition of Toshiba Carrier Corporation. We will continue to build on our momentum as we enter 2023 with solid backlog levels and a healthy balance sheet. As the leading climate solutions provider, we are well-positioned to fully realize the benefits from the secular trends transforming our industry and planet."

Full-Year 2022 Results

Carrier's 2022 sales of $20.4 billion decreased 1% compared to the prior year including organic sales growth of 8%, a 3% headwind from currency translation and a 6% net negative impact from acquisitions and divestitures. GAAP operating profit of $4.5 billion increased 71% and adjusted operating profit increased 3% to $2.9 billion. Adjusted operating profit increased despite lower reported sales due to the Chubb divestiture and persistent supply chain challenges. Strong price realization more than offset unprecedented inflation and productivity savings more than offset strategic incremental investments.

GAAP EPS was $4.10 and adjusted EPS was $2.34. Net income was $3.5 billion, and adjusted net income was $2.0 billion. Net cash flows provided by operating activities were $1.7 billion and capital expenditures were $353 million, resulting in free cash flow of $1.4 billion. 2022 capital deployment included a net decrease of about $750 million in our long-term debt, over $500 million in acquisitions, $509 million in dividend payments and the repurchase of almost $1.4 billion of common stock.

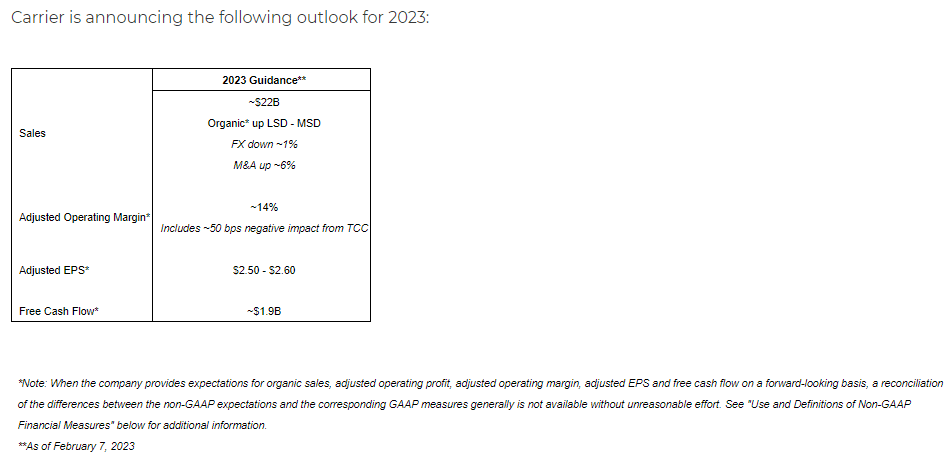

Full-Year 2023 Guidance

Please share the news

23

23