The global air conditioning market contracted again in 2016, a new BSRIA report reveals, but growth is expected to resume this year.

The latest BSRIA market intelligence study shows that the contraction slowed down in 2016, shrinking by 1% to $92.6bn. Although an improvement on 2015’s fall of 5%, the market had grown by 7% in 2014.

The 2016 result was not as bad as had initially been expected. BSRIA says that this was mainly due to a late recovery in the Chinese market due to a spate of hot weather and the Government’s issue of a new five year plan. Brazil and Saudi Arabia were the other main contributors to the final figure.

Packaged products accounted for almost 85% of the total value of the market, with Asia Pacific accounting for some 60% of the world market by volume.

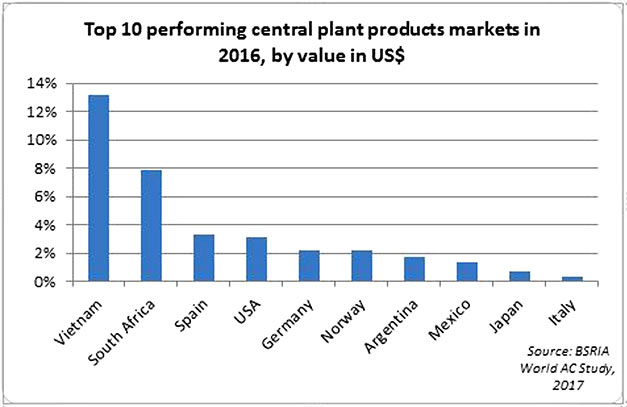

The central plant markets are said to have performed poorly with the exception of the Americas. The US, which is the second biggest central plant market, showed moderate growth. The slowdown in investments in industrial new construction and the low growth in healthcare and education is blamed for restricting further market expansion. At the other end, the demand in the commercial office and hospitality verticals remained strong, leading to some growth.

Continued pressures on the Brazilian economy took their toll in the air conditioning markets as the country experiences its worst recession on record.

Good for Europe, except UK

According to Saziye Dickson, BSRIA’s senior market research consultant, 2016 was generally a good year in Europe and South East Asia region. “The scorching heat and resumed growth – especially in southern Europe – has benefited the air conditioning markets across the region and particularly saw a boost of the Italian market.”

These factors saw the European air conditioning market grow by 13% after sluggish performance in the last few years. Growth was said to be evident in most of the large air conditioning markets in Europe, apart from the UK. The vote to leave the EU is said to have caused a lot of uncertainty and the British pound fell to its lowest in the last 31 years. Overall, BSRIA reports a lack of UK demand for office spaces, combined with project delays due to uncertainty about tenant demand, impacted on the purchase and installation of air conditioning.

South East Asia benefits from having a hot climate with an immature air conditioning market. This, along with good economic growth through foreign direct Investments, new construction activities, tourism and public investments, resulted in a 7% overall growth.

Americas

The Americas region contracted by 5% in volume terms and reached nearly 27 million units in 2016. BSRIA observes a real mixture of performances within the biggest markets in the region with the US, Canada and Mexico all showing strong growth while the Brazilian (-46%), and Argentinian markets (-15%) plummeted. Political instability and economic downturn were cited as the main reasons behind these falls.

The overall growth in the US air conditioning market showed a promising increase of 8% in 2016. The growth was evident across all product areas bar the large packaged segment. Consumer spending, new construction activities, especially in the office, hospitality and retail markets, as well as low interest rates, were some of the main drivers in 2016.

The MEIA region recorded a small decline in 2016 after two years of growth. The total air conditioning market was valued at just over 13 million units. The biggest market in the region was India which recorded an 8% growth but the Saudi market continued to suffer due to the lack of government investments and contracted by 25%, bringing the whole region down by 1%. The growth in India was driven by the residential air conditioning sector, soaring temperatures in May and a stable rupee allowing better business planning and foreign direct investments.

Portables

Total sales of portables were estimated at some two million units in 2016, an increase of 15% compared to 2015, and a value of US$563m. The US – the biggest market for portables –accounted for more than half of the global sales and saw a 29% boost in the market. This was partly driven by favourable weather conditions, but also the availability of very competitively-priced units.

Modest increases were seen in Europe and South East Asia but the market is also seeing competition from low cost splits.

Window/through the wall units

The window/through the wall market dropped by 2% in volume in 2016 as split systems continue to take share. The market reduced to almost 12 million units and $2.4 billion in value. The USA is, again, the biggest market for these products, accounting for 60% in volume terms. The favourable US economic climate resulted in a growth of 9% to reach seven million units. The other major markets continue to be India and Saudi Arabia, but both recorded a fall in 2016.

BSRIA expects this market is expected to show modest growth over the forecast period up to 2021, purely driven by the growth in the US market.

Split systems

Split systems account for 80% of the market – by far the largest segment of the global market, and valued at $70bn in 2016. Multi splits account for 3% and VRF accounts for 14% in value terms. The total splits market has reached just over 100 million units, a 1% drop compared with 2015.

China, the world’s biggest market, recorded a 5% drop, restricting global growth. The highest growth markets among the key air conditioning countries were South Korea (35%), which benefitted from a hot summer, Vietnam (16%), India (11%) and the US (6%).

The uptake of inverter technology accelerated across many markets in 2016. According to BSRIA, the majority of Europe is now nearly 100% inverter, with the exception of Russia where legislation does not encourage inverters and the tough economic conditions means the market is dominated by low cost products.

“2016 has been an amazing year for both multi splits and the VRF market with both recording double digit growth rates,” Saziye Dickson commented.

“The top three biggest multi splits markets recorded some growth, Italy (49%), South Korea (2%) and the US (27%) contributing to global growth. The multi splits market meets the demand between the single splits and Mini-VRF (<20kW) range in both residential and commercial segment.”

Observing that the VRF market has been described as “recession proof”, Dickson said: “The product’s adaptability in both new and refurbishment for residential and light commercial applications has proved to be key in recent years, where there has been a shift away from new construction towards refurbishment projects. The increasing ability for VRFs to be equipped with BACS systems is also generating new opportunities for the VRF market.”

Increasingly, ventilation products are being installed with VRF systems, so that VRFs are able to compete better with chiller solutions in applications, where fresh air is required.

BSRIA expects the global splits and VRF markets to show a modest growth of 2% CAGR in volume terms between 2015 and 2021. “An increase in the penetration of air conditioning, especially in developing countries, combined with economic recovery in Europe will be the main drivers,” observed Saziye Dickson. “The biggest growth by region is expected to be the Middle East India and Africa region followed by Europe.”

Rooftops

The global rooftops market was estimated at around 1.2 million units, a 1% drop compared to 2015 in volume terms. The US and Canada remain the biggest two markets by far, accounting for nearly 90% of the global sales in 2016.

With online trading continuing to take market share from the high street – the traditional market for rooftops – BSRIA sees limited growth in this sector. It predicts a modest growth of 2.6% CAGR in volume terms between 2015 and 2021.

Central plant

The global chiller and airside market was valued as $14.5bn, representing a 2% drop compared with 2015. Chillers represented some 50% of the central plant market by value in 2016. The Americas region was the only continent that recorded any growth thanks to strong performance in the US market.

BSRIA observes that, although economic growth is evident in many regions, projects are slow to reach the building services purchasing stage, and the market has continued to suffer from a lack of new commercial construction.

The biggest region, Asia Pacific, accounts for 35%, followed by Europe with 26%, the Americas region 25% and MEIA region with 14%. Growth levels have generally been modest with the largest markets being between 1-5%. However, globally, the trend in the chiller market is driven by the two giants, the US and China, which, combined, represent 45% of the global market.

The biggest developments in the chiller market were the increased uptake of inverter technology, as well as heat pump applications, especially in Europe. Energy efficiency laws and tough competition from DX systems is driving the chiller companies to up their game.

Overall, the central plant market is expected to show a moderate growth across all regions for the forecast period at around 3% CAGR in value terms between 2015 and 2021.