UK: The global air conditioning market contracted by 5% in value terms in 2015 and will recover at a slower pace than previously projected, says BSRIA.

The recently published BSRIA market intelligence study (World Air Conditioning Study, published in March 2016, covering 30 countries) records disappointing figures for 2015, after the market had shown a growth of 7% in 2014.

The main driver in 2014 – an increase in the Asian Pacific region – was also key in the drop of the total world market in 2015. The biggest packaged air conditioning market, accounting for 61% of the world market by volume, declined by 5%. The top four biggest markets, China, Japan, Indonesia and South Korea all contracted and contributed to the downward trend.

China’s turbulent year economic year had a negative impact on the air conditioning market. The PAC market reached 49.3 million units, down by 7% compared to 2014. The mini-VRF (20kW) was the only market that has managed to grow amongst PAC products due to the growing demand from residential applications.

A bit of good news from the region came from Vietnam, Australia and Philippines. The growing GDP and attractive economic characteristics mean the Vietnamese market has good potential for Foreign Direct Investments. However, the growth in the splits market was mostly down to hot weather during the peak season and after-season. In Australia, demand has grown in 2015 as a result of a strong residential market in both the apartment and housing sectors.

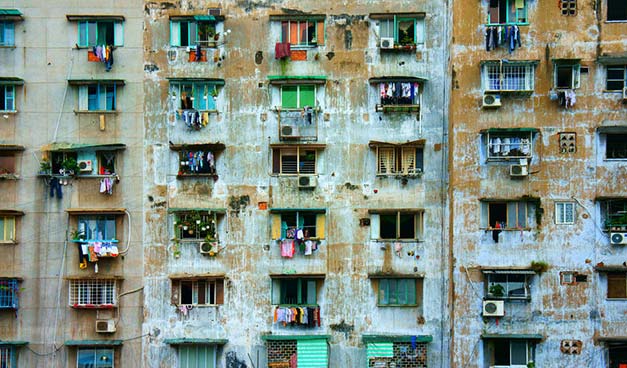

In the Philippines the solid growth of packaged products market is attributed to the flourishing new private construction especially the high rise condominium, commercial offices, shopping malls and other applications.

The Americas region also mirrored the trend and contracted by 2% in volume terms to 27.4 million units in 2015. The previous year’s biggest contributor Brazil contracted by 18% after returning 28% growth in 2014.

The growth in the US market, the biggest market in the region, offset the negative impact in the continent. The PAC market grew by 4% to 16.1 million units.

The European PAC market grew by 2% in 2015 compared to the previous year’s drop of 16% in volume terms. Growth in Spain, France, Italy, Turkey, Greece, Sweden and Germany all contributed to the growth in the region, in order of importance. The biggest PAC market, Russia, meanwhile, recorded a massive drop of 18% by volume. The sharp contraction in the Russian economy, devaluation of its currency by over 50%, economic sanctions and low oil prices all had an impact on many industries including air conditioning.

The MEIA region managed to show another year of growth in 2015 increasing from 11.6 million to 12.5 million units. India, the biggest AC market in the region, continued to be the major contributor to this growth. The market grew by 4% in volume terms and reached four million units. There were several contributing factors such as growing GDP, low raw material prices, as India relies on imports of raw materials, and resumption of projects which were on hold pre-election in 2014.

The biggest four major markets all recorded growth in 2015 – namely: India, Saudi Arabia, Nigeria and Egypt. Iran, Bangladesh and South Africa were all amongst growing markets in the region.

The countries that failed to grow were UAE, Kuwait and Qatar. The drop in oil prices which these three countries heavily relies on, caused reduction in public spending consequently impacting the air conditioning industry.

- Portables

Total sales of portables in 2015 were estimated at two million units, representing an increase of 7% compared to 2014 and valued at US$524m. The biggest moveables market, the United States grew by 16% and reached one million units. The main reason behind the growth in the US was weather patterns, but also competitive pricing, which is moving downwards as competition toughens.

The hot summer in Europe is said to have caused the portables market to raise significantly; Italy, Spain and France, growing by 89%, 49% and 38% respectively by volume.

The world’s other significant markets – Brazil and China – also managed to grow however it was at more modest levels, 3% and 1% in volume terms.

Although this market is difficult to forecast due to seasonal sales, BSRIA expects this market to grow at around three per cent CAGR between the period of 2014-2020 in volume terms.

- Windows/through the wall

The windows/through the wall unit market grew by 2% in volume. The market was valued as 12 million units and US$2.6bn. This growth was mostly down to world’s two biggest markets, the USA and Saudi Arabia, showing increases of 4% and 14%, respectively. The two markets accounted for round 60% of the global market.

The warm summer was thought to be the main reason for the increase in the US and reasonable pricing of new energy efficient windows units compared to splits was the main reason behind the increase in Saudi Arabia.

- Indoor packaged

The indoor packaged unit, defined as self-contained units for light commercial applications, is a relatively niche market and saw sales of just over 100,000 units in 2015 which has increased from 96,000 units in 2014 with a corresponding value of US$426m. Japan by far the biggest market for this product accounting for around quarter of the total market by volume followed by Italy, Spain, China and USA.